We get it, African tech has potential

By Abderrahmane Chaoui

About the author

Abderrahmane Chaoui is the founder of Sendemo, a research-based consultancy firm with a focus on African entrepreneurial and innovation ecosystems. It originated as a research project across 13 ecosystems on the continent to build strong convictions and a good understanding of local ground context.

Sendemo's scope of expertise includes leading ecosystem assessment and system-level advisory, the design of market expansion strategies for investors and scale-ups, open innovation and venture building. Grounded in research and investigation, Sendemo's work is at the frontier between advisory, research and advocacy.

Before that, Abderrahmane founded a biotech startup and worked as a strategy consultant for Fabernovel (now part of EY).

Harnessing the momentum

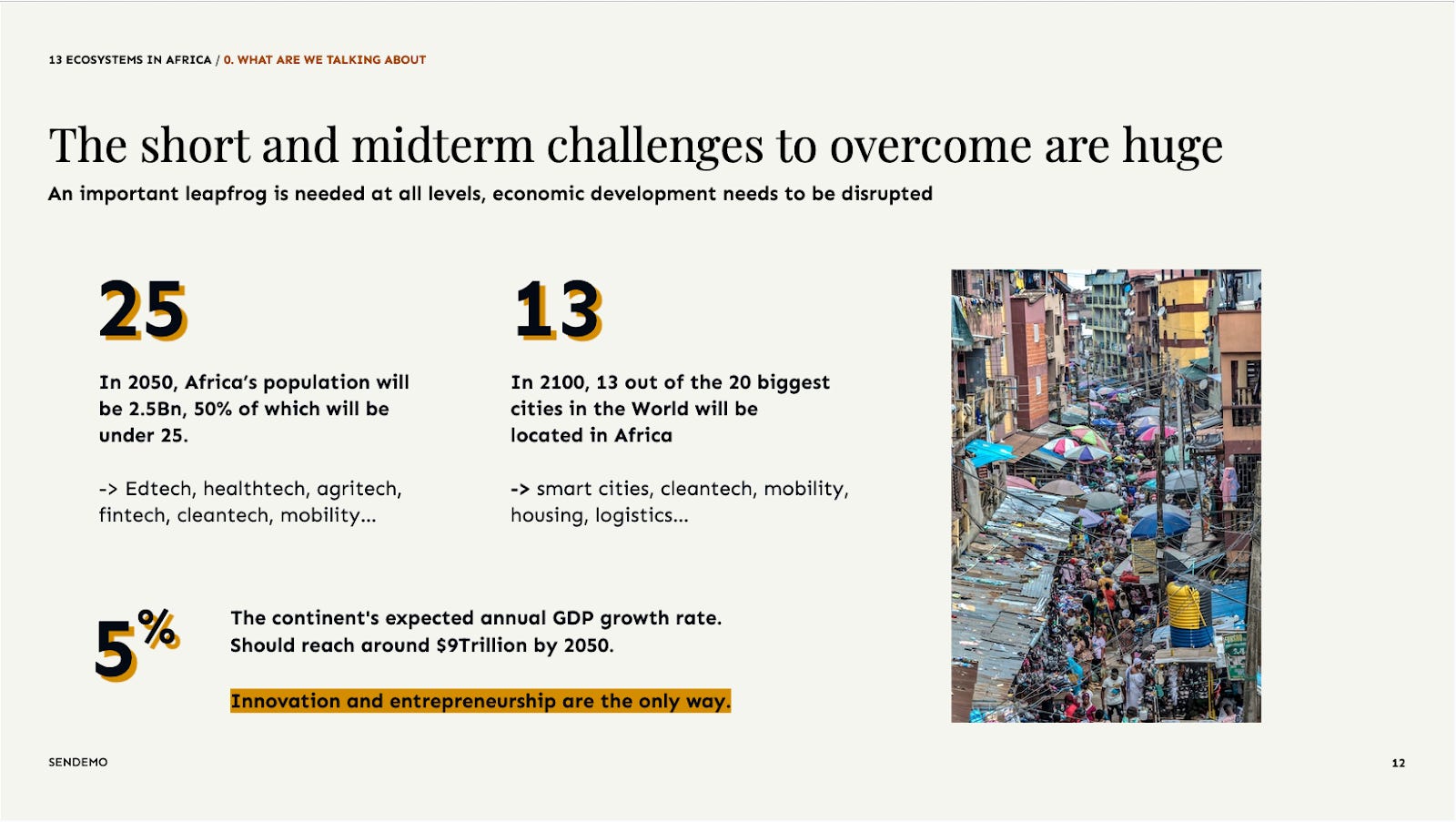

The past decades have been marked by the advent of a new type of company: the tech startup. Riding the internet’s transformative wave, intrepid founders have reinvented the way we buy, move, communicate, heal and more. Buoyed by a peculiar type of financing, risk capital, tech startups have made a rapid and blunt appearance in economies around the world. Including in Africa.

A popular startup idiom encourages founders to “build something people want”. In the African context, that idiom could be substituted for “build something people need”.

Startups in Africa have been key in delivering the basic services many on the continent still lack. Bringing electricity to off-grid areas, providing access to financing, modernizing agriculture, extending safe drinking water distribution… Startups will be a cardinal piece in Africa’s demographic puzzle, which will see a predicted 1.2b people under 25 living on the continent by 2050.

Startups’ pivotal role in the continent’s future has generated much enthusiasm, both on the continent and abroad. Providing various services to potentially hundreds of millions of people seems to be viewed as good business. The year 2021 materialized that heightened interest, as it saw African startups raise a combined $5.2B, more than triple what they bagged in 2020. A substantial amount of that capital came from abroad, with American investors standing out as they contributed 40% of the total invested.

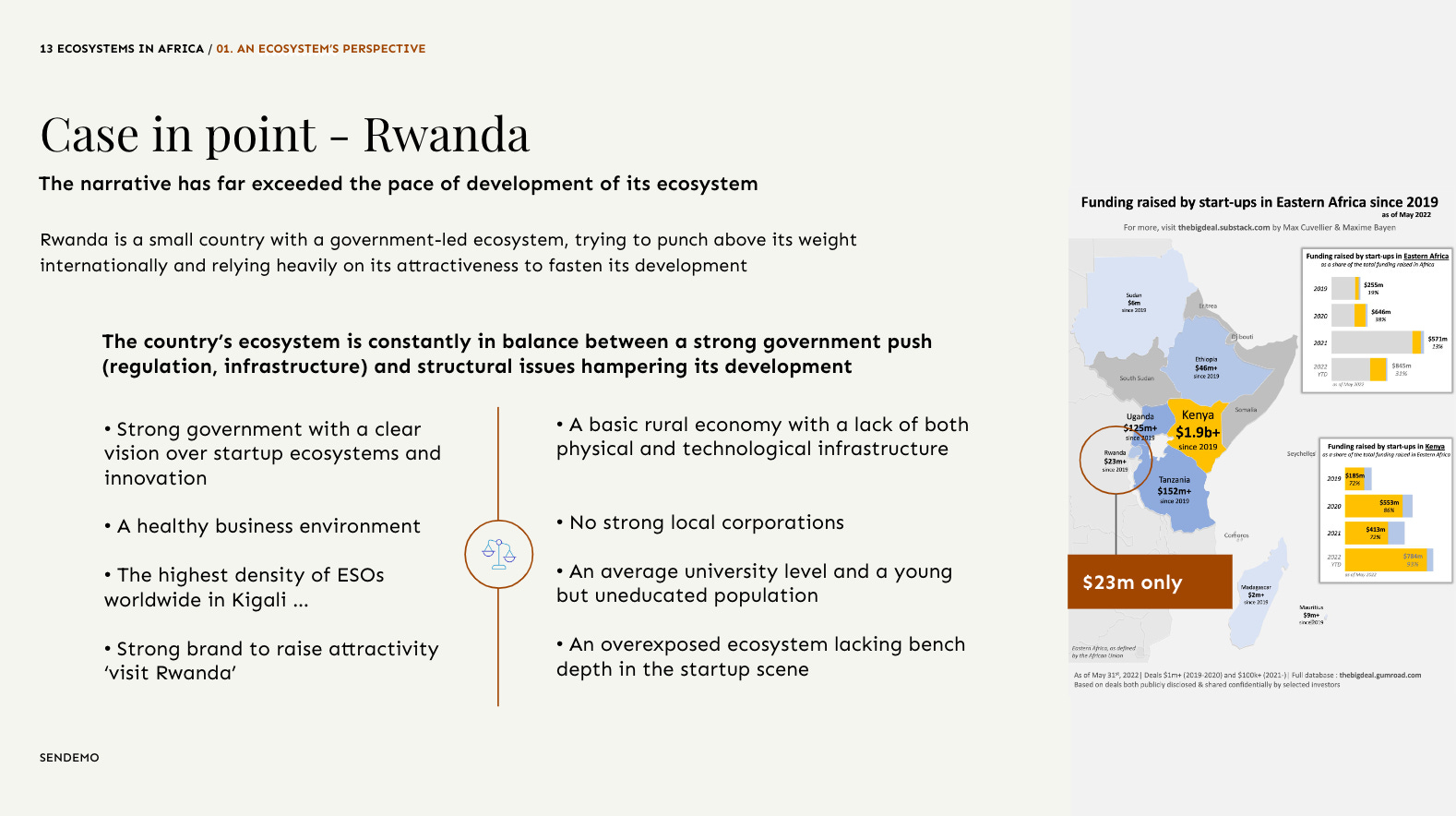

Increased funding numbers have been accompanied, and arguably boosted, by a maturing African startup ecosystem. Across all countries, no matter the size of the ecosystem, hundreds of incubators, accelerators, and tech hubs have emerged throughout the continent. The palpable excitement has been picked up by many African governments. This has led to both concrete pro-startup measures and nebulous PR announcements, but the overall trend is a positive one. Seeing African public officials and journalists flaunting their country as “Africa’s tech hub” is a daily occurrence for any avid LinkedIn user.

The fervor surrounding Africa’s booming startup ecosystem awakens, in a way, the pan-African utopias fostered during the post-independence era. That feeling is exhilarating, precious, and cannot be squandered. It should be channeled towards the continent’s good in a long-term and sustainable manner.

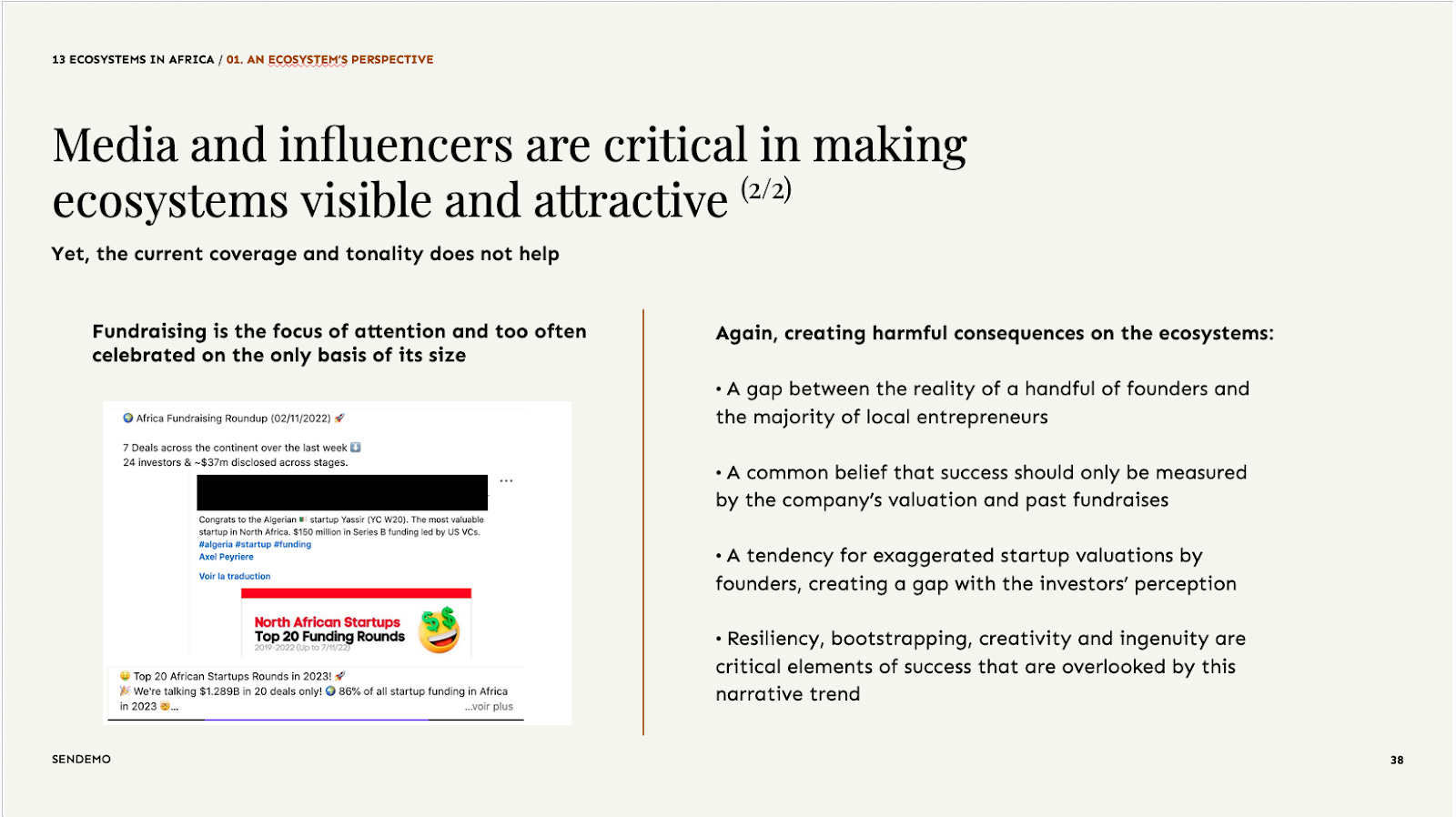

In that quest, African startup media holds a solemn responsibility.

Setting the tone

“The African startup media” includes classic media outlets, but also prominent industry observers and commentators, who benefit from a substantial audience and the latter’s trust. In an ecosystem where good information is still rare, the ones who hold it wield significant influence.

African startup media, and startup media in general, is made up of tech enthusiasts. You’ll be hard-pressed to find an African tech journalist who doesn’t want the ecosystem to thrive. This makes their job harder: they have to find the right balance between promoting the ecosystem they love, soberly decoding its nuances, all while honestly covering its failings. The tone employed and angles taken while doing so shape the ecosystem’s discourse and subsequent development.

Constant fundraising celebrations disseminate the idea that founders’ worth resides in the money they raised rather than the key milestones they hit. Praising government announcements without diligently following up on their application renders half-veiled truths. Oversimplifying an ecosystem’s complexity for the sake of “promotion” increases the risk of foreign investors getting burned.

After roughly 5 years of expanding African startup media coverage, a candid assessment is of the essence.

Ethics & responsibility must prevail

So far, the ecosystem’s coverage has been overwhelmingly uplifting, motivational, dare I say rose-tinted? Bar the couple of fantastic African startup journalists out there, of course. But they are far from the majority.

This largely positive and simplified coverage of the African startup scene has, in my opinion, circulated the idea that “everyone” should try their chance at entrepreneurship. The “boring” traits that statistically make founders successful, such as previous professional experience, deep academic prowess, or just good old family connections are brushed over. It’s more fun to talk about young, daring, bold, valiant founders who came up from nothing. Unfortunately, that’s far from what most African founders look like.

Being vague and simplistic about the ins and outs of entrepreneurship in the African context is quasi-criminal because it has real-life impacts on its readers.

It can lead some African youngsters to dive into entrepreneurship head-on when both the ecosystem and themselves could’ve benefited from gaining experience at an existing company. An African youngster foregoing university to launch their company will very probably fail. In Europe, a robust safety net and well-off parents would shield our fictional youngster from any outrageously nefarious consequences. In Africa, our fictional youngster runs much bigger financial, social, and overall life risks by taking that same leap. No one is there to catch them when they fall.

The case against simplified reporting applies on a more macro scale. Media outlets crowning country A or country B as the irresistible African “Silicon Valley” based on grandiloquent government announcements actively breed deception. There is absolutely no way any African country is remotely close to Silicon Valley. Silicon Valley’s ecosystem is 60+ years old, while Africa’s has barely celebrated its first decade.

The scarcity of deeper reporting alternatives will sometimes lead foreign investors to buy into that cursory narrative.

When these investors do come and realize that the reality is more complicated, and that the country isn’t actually “Silicon Valley”, they won’t hesitate to share their frustration. More often than not, they will generalize their experience to the entire continent. This penalizes everyone.

I understand African startup media’s desire to promote the ecosystem, shine it in a good light, and attract the world to it. But pragmatically, this approach is shortsighted. A mindset switch has to occur, one where the African startup media deciphers complexities rather than erects billboards.

Building Africa’s knowledge stack

We have all understood that the African startup ecosystem has potential. We have all internalized the opportunity. Now, we need to lay out the ecosystem’s knowledge stack, define what success means to us, how to balance foreign investments with local interests and uncover our continent’s singular complexities.

Egypt’s population is 67% unbanked, noted. That’s a great opportunity for fintech innovation, sure. But how do Egyptian fintech founders deal with currency devaluation? What does the fintech legislation look like in Egypt? How do Egyptian fintechs deal with the population’s cash preference? Why is it that some Egyptian founders expand to Saudi Arabia rather than Africa?

Senegal’s government has passed a Startup Act, fantastic. An American startup has raised $200M to launch in Senegal, wonderful. But has the Startup Act been implemented? Is it working? What does the construction of the new, massive Ndayane port mean for the country’s logistics startups? Why is it that Wasoko, a $100M+ funded startup, quietly retracted from Senegal?

Conclusion

The most exciting part about the continent’s startup rise is its unabashed pan-Africanism. Everyone in the ecosystem knows that the African startup game is a continental one, not a national one. African M&As are happening, pan-African expansion is on founders’ lips, startup visas are circulating, the AfCTFA (an African free trade agreement) is materializing… It’s a very exciting time.

As stated throughout this piece, the media landscape has, is and will continue to play a crucial role in the ecosystem’s development. What it must avoid at all costs is conflating activism with publicizing.

The African startup media should act as pan-African activists, laying the informational groundwork for Africa’s startup ecosystem to bring dignity and prosperity to the continent. This entails asking the tough questions, reporting full instead of half-veiled truths, and understanding their work’s profound reverberations.

Media aren’t the only ones that have to go above and beyond. Investors should play an active role in building up these nascent ecosystems, actively supporting their founders and collaborating with the organizations that train them. Successful founders should use their newfound resources to build the infrastructure they wish they had when starting their companies. Startup support organizations (SSOs) should continuously question how they can offer more and more relevant, specialized services to the founders they incubate. And we as observers, consultants or simple consumers, must also understand the importance of the time we live in, and the consequences of our choices.

Everyone has a role to play in making the African startup ecosystem a success for Africans. But the media especially.

Continue your reading by deep-diving into Abderrahmane’s full report on 10+ African startup ecosystems.

The Realistic Optimist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice.