This piece was written in collaboration with BackScoop, a daily newsletter covering all aspects of the buzzing Southeast Asian startup ecosystem. Unlike your typical tech news... BackScoop is fun, easy to digest, and tells you all you need to know in 5 minutes.

Join thousands of leading founders, investors, and operators in SEA reading BackScoop every morning. Subscribe for free here.

Exceptional situations require exceptional actions

One of my favorite French rappers once said “it’s in chaos that genius articulates itself”. After separating from Malaysia and gaining its independence in 1965, chaos would be an adequate word to describe Singapore’s situation. The embryonic nation had no natural resources, a more than complicated ethnic makeup, and no blueprint for success. What it did have was brilliant people at its helm and a burning desire to stand by itself.

Core to any infrastructural or social project Singapore’s leaders wanted to take on, money and the management of it would be one of the city state’s focal points in the early days. How could Singapore simultaneously be integrated into the globalized economy, a prerequisite given its tiny size, and shielded from the same globalized economy’s mood swings?

The first move in such a quest was to scrap the common currency project it had with Malaysia, after negotiations failed to guarantee Singapore’s full control over its reserve. This obsession over the country’s reserves would prove to be a constant in this story.

The Singaporean dollar was thus born, first pegged to the British pound, then to a basket of currencies, before being finally floated from 1985 onwards. To this day, the currency’s exchange rate remains closely guarded and monitored by the Monetary Authority of Singapore. The exchange rate and its management would become the cornerstone of how Singaporean officials dealt with inflation, contrary to the common practices of central banks at the time.

“It was Goh Keng See (Singapore’s deputy prime minister) who decided not to follow other central banks when they ruled interest rates were the most effective lever for controlling inflation. Instead, citing Singapore’s extensive trade and capital flows, Goh judged it more effective to target the exchange rate. This is still the practice in Singapore.” - Australian Financial Review

Having more control over its currency’s exchange rate was a start, but it wouldn’t finance the myriad of developments Singapore needed. After experiencing fast economic growth during its first couple of “independent” decades, the country was left with a budget surplus. Instead of sitting on it, the government decided to turn that extra cash into the basis for a sovereign wealth fund, an unorthodox idea for non-commodity-rich countries at the time.

In 1981, GIC was established to do just that: invest the country’s reserves into long-term, high-yield investment opportunities which could provide the country with ample financial riches to tap into in times of need. The initiative was led by the same Goh Keng See who had once been vocal about the need for Singapore’s sovereignty over its reserves.

GIC was actually the Singaporean government’s second initiative aimed at better fructifying the country’s early but valuable assets. In 1974, Temasek was established as a way to shift the management of Singapore’s 35 public companies to a team of investment professionals. Temasek is a private company, managed independently, with the Singaporean government as its sole shareholder. The rationale behind Temasek was simple: politicians aren’t business-savvy, and policymaking should be clearly separated from asset management.

The reasoning and principles behind the establishment of both Temasek and GIC, whereby the Singaporean government placed its assets in the hands of public-owned yet private-thinking entities, would prove to be one of the greatest strokes of financial genius in modern history.

“The individual investments of GIC and Temasek are the responsibility of their respective management teams, while the Government monitors the performance of their overall portfolio. GIC and Temasek operate on a purely commercial basis in order to maximize long-term risk-adjusted returns, and the individual investment decisions are fully independent of any Government interference or influence. This is an important governance principle that we seek to maintain.” - Temasek

Local cornerstone, international giant

40 years later, GIC and Temasek are both household names in the international investing scene, especially in the secretive sovereign wealth fund world. Following prudent yet ambitious long-term bets, their assets under management (AUM) have ballooned to quasi-unimaginable sums.

“Even by the secretive standards of sovereign wealth funds, GIC stands apart for its riches and discretion. It does not release annual returns and will not say how much it manages, though estimates from data providers put it as high as US$744 billion ($999.6 billion). New rules passed in Parliament could raise that to almost US$900 billion, making it the third-largest fund of its kind after Norway and China.” - Straits Times

Not only that, but returns from GIC and Temasek have been the single biggest contributor to the Singaporean government’s budget since 2018. Their extensive financial reserves also act as a lifeline for the government to tap into if required, most notably during the covid crisis when officials used $42.7B from its reserves to support pandemic-relief efforts.

GIC and Temasek invest in a plethora of different asset classes, including public and private equities, real estate, and bonds. The 20-year time horizon by which they view their investments, and the fact that their sole shareholder leaves them alone, enables them to weather market turbulences by staying put for the long game.

They were one of the first institutional entities to dip their toes into the fast-growing Asian markets, with seminal investments in Chinese giants Xiaomi and Alibaba for example. Due in part to the financial firepower GIC and Temasek yield, small, resource-poor Singapore turned itself into an undisputed global financial hub in the span of a couple of decades.

Relevance in global VC

GIC and Temasek have always been global by nature, whether it be through their investment mandate (GIC invests only outside of Singapore) or through their staff, in which non-Singaporeans are heavily represented. GIC even recruited American investment professionals to train its teams internally at the organization’s dawn.

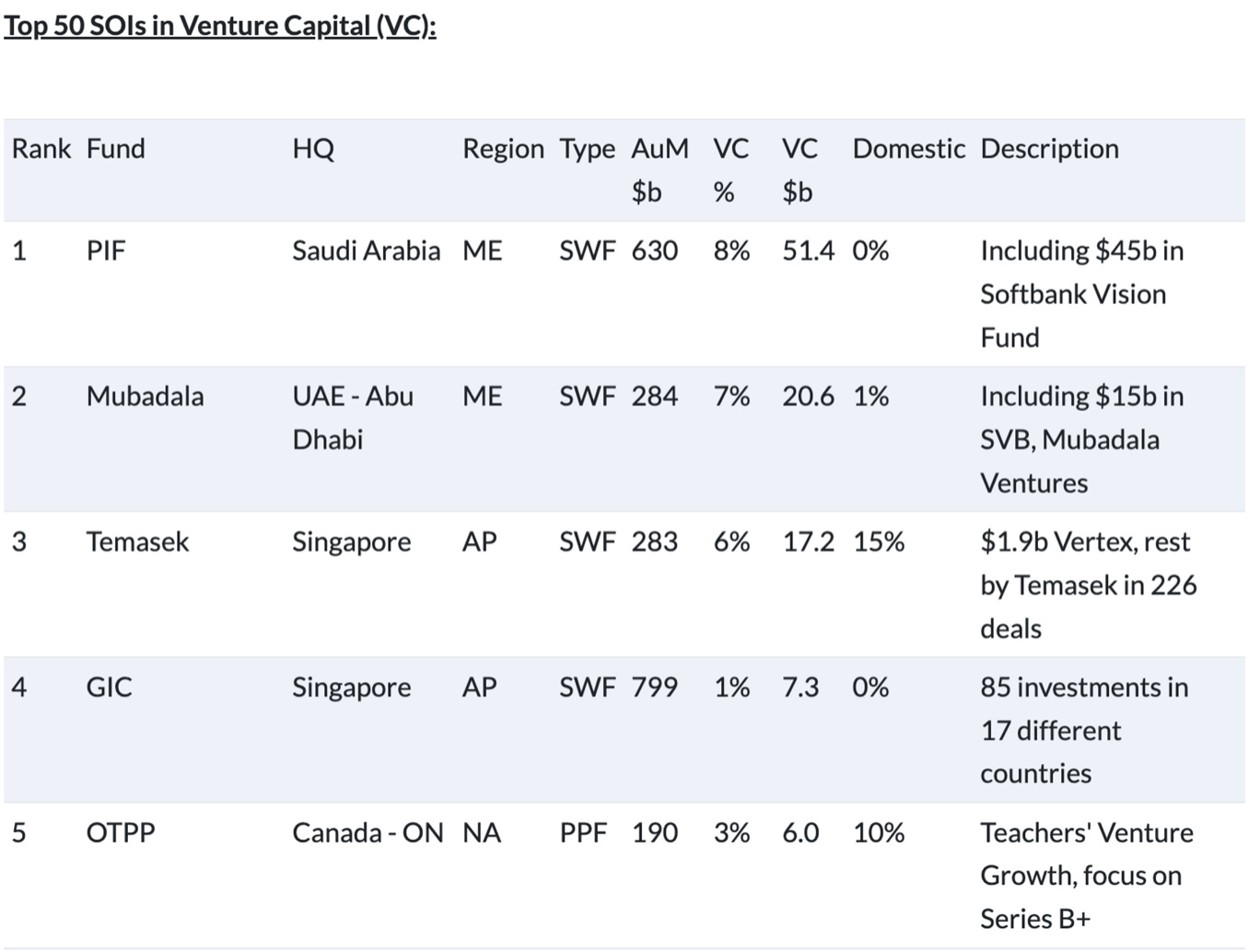

As part of their asset diversification and long-term vision plays, both funds have been active in the global venture capital scene almost since inception. While the percentage of funds they allocate to venture capital is relatively small, the sheer size of the funds makes these amounts more than significant.

“Since its founding, GIC has invested around $254B in venture capital, investing directly into VCs, startups, or alongside renowned names such as Sequoia or Andreesen Horowitz. Some rockstars in GIC’s portfolio include but are not limited to DoorDash, Affirm, Nubank, and Klarna, as well as a slew of Chinese heavy-weights such as Meituan and Alibaba. Recently, GIC led crypto’s Chainalysis Series F investment.” - Realistic Optimist

Temasek is orders of magnitude more bullish than GIC on venture capital though. In 2021, Temasek poured $5.1B into the sector, compared to GIC’s “meager” $2.1B. Temasek has created an entire structure, Vertex Holdings, to handle its investments in startups worldwide. Spread across 6 standalone funds, Vertex subsidiary VCs enable Temasek to leave almost no startup-stone unturned.

“Each of the Vertex Ventures funds in Israel, USA, China, and SEA & India operate independently, with separate local teams that raise and manage respective funds independently. Vertex Holdings is an anchor investor in each of the Vertex funds, namely: Vertex Ventures China, Vertex Ventures USA, Vertex Ventures Israel, Vertex Ventures SEA & India, Vertex Ventures HC, and Vertex Growth. The holding company was founded in 1988 and is based in Singapore.” - CB Insights

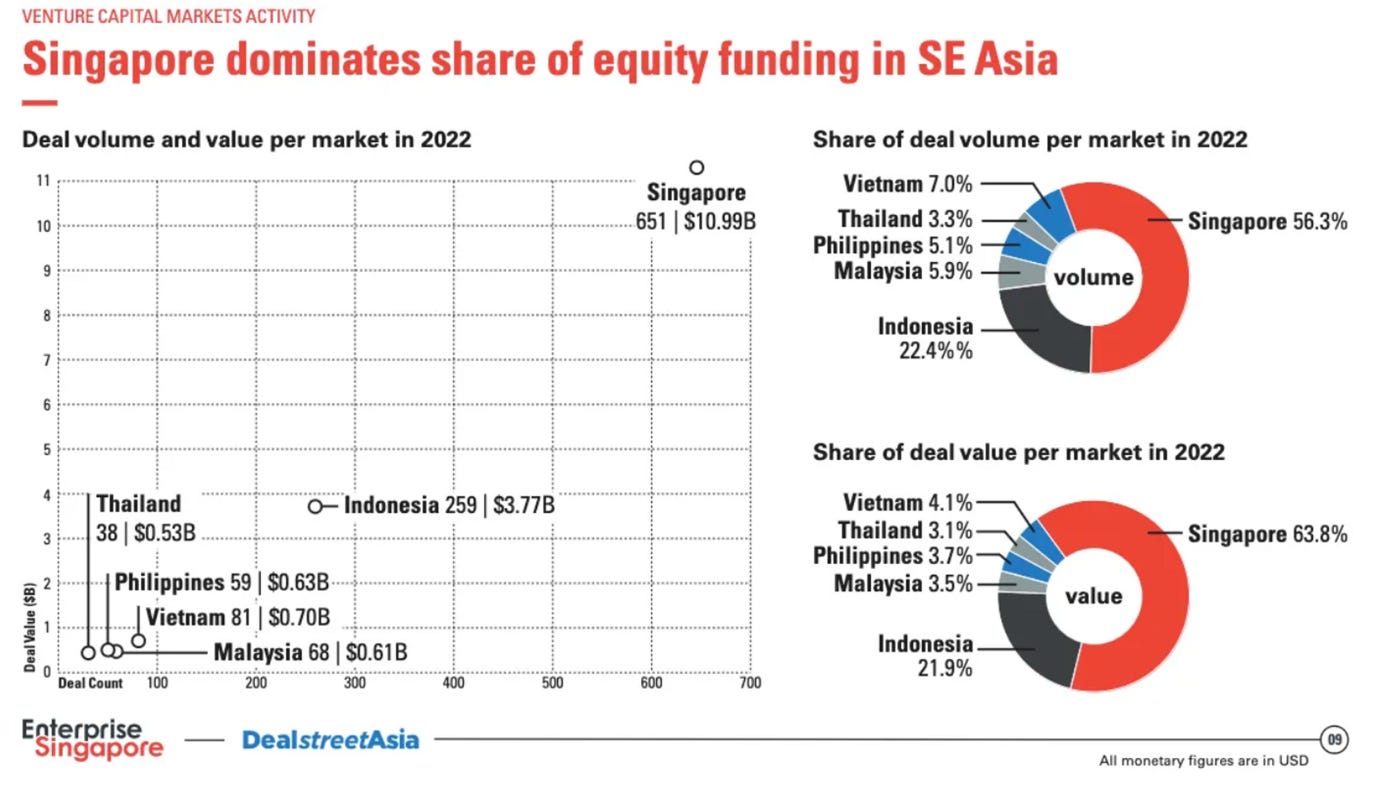

Despite the global 2022 funding winter, both funds have remained active in VC, especially in their home region of Asia. The duo is a stalwart funder of the Southeast Asian startup boom, with Indonesia in particular attracting the favors of the Singaporean financial colossi. This move to Southeast Asia comes as China’s volatile tech regulatory climate, exemplified by Ant’s failed IPO, cools the ardors with which both funds traditionally viewed the Chinese investment landscape.

“Indonesia’s startups have drawn sovereign investors into the country with around US$ 2 billion, the majority funded by Singapore’s GIC and Temasek. However, it has not been plain sailing and Indonesia’s newly listed tech companies did not escape the rout that swept public markets throughout the world in 2022.” - Global SWF

Singapore as a startup hub itself

Likely buoyed by its two sovereign wealth funds’ relevance in the global startup world, Singapore has undertaken the task of developing a buzzing local startup scene as well. In a situation that draws evident parallels to Dubai, the city-state is Southeast Asia’s irrefutable startup center.

“As a major regional trade and economic hub, Singapore hosts a wide range of tech-related forums, conferences, and events in the fields of technology, business, and innovation. These activities not only strengthen the culture of innovation that the government itself promotes, they also provide ideas and networking opportunities for fledgling startups. This is an important intangible aspect of the ecosystem.” - Asian Development Bank

While fully-local unicorns are an impossibility due to the country’s minuscule market size, the preferred scenario for ambitious Asian founders is to set base in Singapore before expanding rapidly into the lucrative neighboring markets of Indonesia, the Philippines, and Malaysia. Founders get to benefit from Singapore’s respected judicial system while tapping into some of the fastest-growing and digitally-native markets in the world. Singapore’s superior infrastructure and overall quality of life also play in the city-state’s favor. Today, regional giants such as Grab, Lazada, and SEA all call Singapore home.

“Favorable taxation and effectiveness of the legal system for adjudicating disputes are other important factors. For the purposes of this study, a startup is identified as Singaporean based on incorporation even if it has a dispersed value chain; for example, with productive operations or sales in other countries.” - Asian Development Bank

While on a quest to attract more and more startup foreign talent to set up shop in Singapore, the city-state might hit a wall that puts a cap on the talent it attracts, namely individual freedoms. Compared to Silicon Valley, Singapore has rigid laws that might curb the enthusiasm of free-thinking and sometimes rebellious founders.

Conclusion

GIC and Temasek’s internal humility and reserved behaviors, which are engrained in both organizations’ corporate values, don’t make them loud actors on the global VC stage. Unlike a16z or Y-Combinator, the Singaporean duo’s public roots make them less pompous and more discreet, casually popping up in your occasional TechCrunch article after leading one of the year’s biggest rounds.

When it comes to their VC activity, which still strongly pales in comparison to the other asset classes they invest in, their elongated and unhindered timeframe enables them to make bets others can’t. Their gargantuan funds allow them to invest in every stage of a company’s development if they want to.

GIC and Temasek’s VC branches are essentially upgraded versions of the Softbank Vision Funds: seemingly unlimited money, but with a much longer timeframe and with a sole shareholder that is fully aligned with the vision. It’s no surprise that Softbank’s Vision Fund II was funded only out of SoftBank’s own balance sheet. Such long-term plays seem to be unfit for constant scrutiny from the public and impatient shareholders.

Finally, Singapore’s local startup ecosystem demonstrates how investing in one’s innovation scene is crucial to warrant a country’s long-term and sustainable development. Just for intellectual fun, it can be argued that communist countries would be the ones to benefit the most from an active, internal startup ecosystem. Indeed, if the schpiel revolves around being self-sufficient and not relying on external powers, the most sensible policy would seem to be funding local, efficient industry leaders instead of publicly-owned dinosaurs fueled by imported commodities. But that’s a debate for another day.

Singapore brained the sovereign wealth fund game by making it possible to get a seat at the table as a resource-poor country. The country’s hefty bets on startups worldwide are a sign of a wider trend that I cover in this piece: the thunderous rise of sovereign wealth funds into the VC world. Armed with monumental funds yet riddled with geopolitical complexities, these sovereign wealth funds will be a force to monitor in our rapidly globalizing startup world.

The Realistic Optimist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice.