Lemon: useful crypto in Argentina

Currency depreciation hurts Argentinians' wallets. Maxi Raimondi explains how crypto can help.

This interview was conducted and transcribed by Timothy Motte.

Special thanks to Jazmín Nogaró, Lemon’s Comms Manager, who brought technical preciseness to the piece.

Biography:

Maxi Raimondi is the CFO of Lemon Cash, an Argentinian startup. Lemon Cash enables users to buy and spend various cryptocurrencies, including stablecoins. Stablecoins are cryptocurrencies pegged to a fiat currency such as the US dollar.

Stablecoins are less volatile than other cryptocurrencies, since they match the value of the currency they are pegged to. This is useful in the Argentinian context, where the local currency (the peso) suffers from chronic depreciation.

Exchanging pesos for stablecoins is a way to preserve the value of one’s bank account. Doing so on crypto rails is cheaper, faster and more convenient than by exchanging cash for cash.

To date, Lemon has raised over $40M in funding.

Argentina is by far LATAM’s most active crypto market. Why?

It’s a marriage of two factors.

The first is Argentina’s tech adoption. The country has always been a regional leader in that aspect. Argentina’s talent is contracted by the world’s largest tech companies and has also built successful tech companies themselves. Think Globant and MercadoLibre (both listed on the Nasdaq) and AuthO, which was acquired for $6.5B. This propensity for tech creation is a result of and results in widespread tech adoption. National smartphone penetration exceeds 95%.

The less prideful factor is Argentina’s continuous economic crises. Over the past decades, high government spending and debt defaults have contributed to weakening the value of Argentina’s currency, the peso. The situation is further complicated by the lack of a single exchange rate: the government, the black market and other actors each have their own. On top of losing value, it’s hard to know what a peso is actually worth.

This is a serious problem. Argentines paid in peso don’t know what the salary they receive today will be worth in a month. Argentines have become experts at finding ways to cope. One of those ways is buying and using another, more stable currency such as the US dollar.

Cryptocurrencies are another good choice. Bitcoin and stablecoins are easily purchasable online and are less volatile than the peso. Exchanging pesos for one of those is an efficient protection mechanism against the peso’s devaluation.

Cryptocurrencies also have the advantage of being purchasable 24/7. If one were to exchange physical peso for physical $USD, they’d have to queue up at the bank and could only do so during bank hours, Monday through Friday. Lemon doesn’t have those limits; we saw a peak of stablecoin purchases during a recent election week-end, for example.

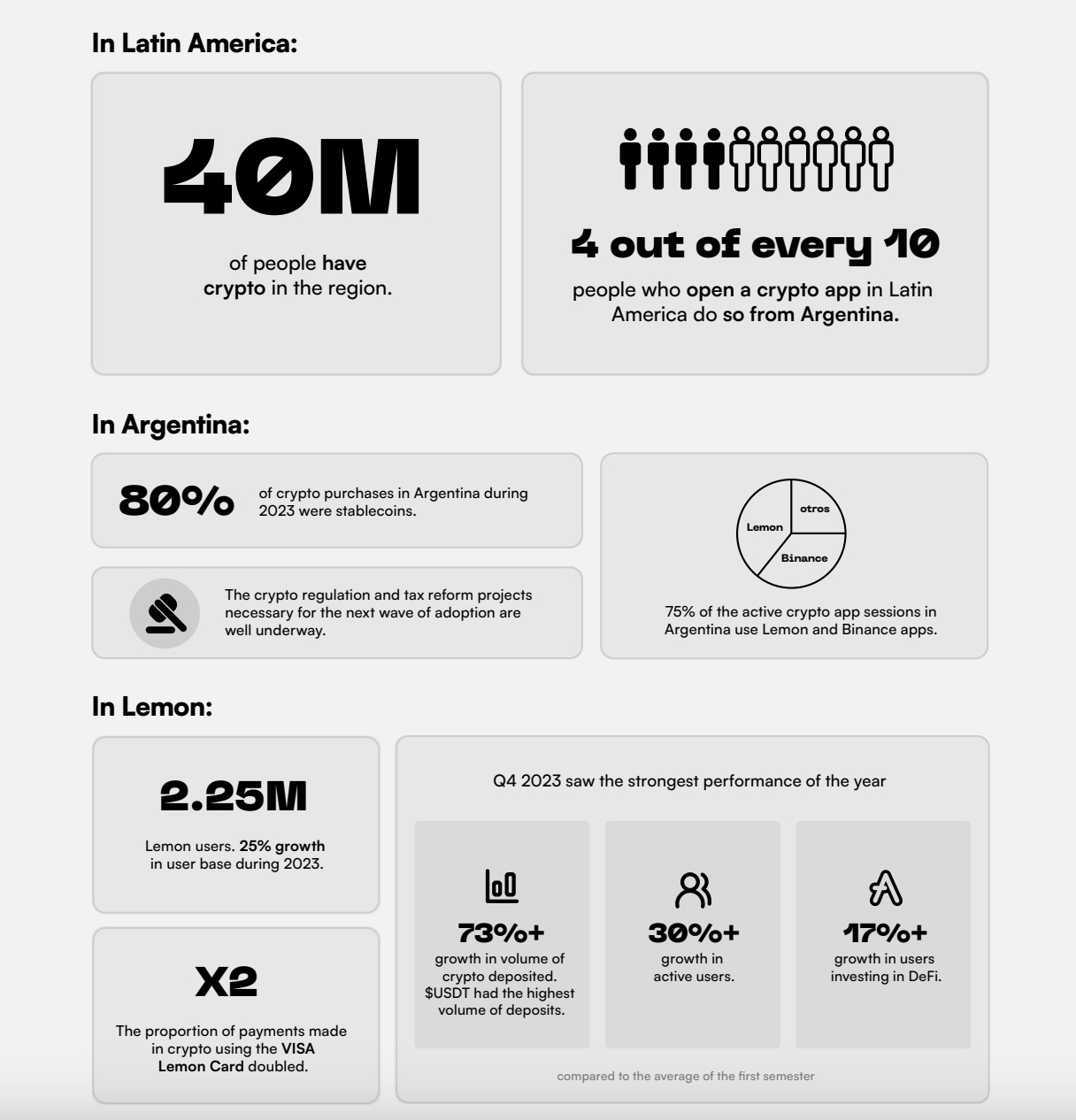

Source: Lemon’s state of the crypto industry in LATAM 2023 report

So Lemon has become an alternative bank of sorts?

No, because we don’t have a banking license yet. People can’t receive their salaries on their Lemon account, although that’s clearly our vision. To be regulatorily precise, Lemon is currently a CVU (digital wallet) but only a CBU (a proper bank account) can provide banking services.

Banks in Argentina don’t have crypto licenses yet, so becoming a CBU would bar us from our main business. For now, we are more of a dual wallet. We enable users to exchange their pesos for the cryptocurrency of their choice and use that cryptocurrency locally, through our Visa card.

While we aren’t a bank and thus don’t lend out deposits, we’ve released Lemon Earn, whereby users can invest in DeFi protocols and earn interest.

Tell me more about that Lemon Visa card. How does it work?