Biography

Juan Pablo Ortega is the co-founder of Yuno, a Colombian global payments startup. Before Yuno, Juan Pablo co-founded Rappi, Colombia’s first unicorn.

He holds a bachelor's degree in Applied Economics and Management from Cornell University.

Not a blip

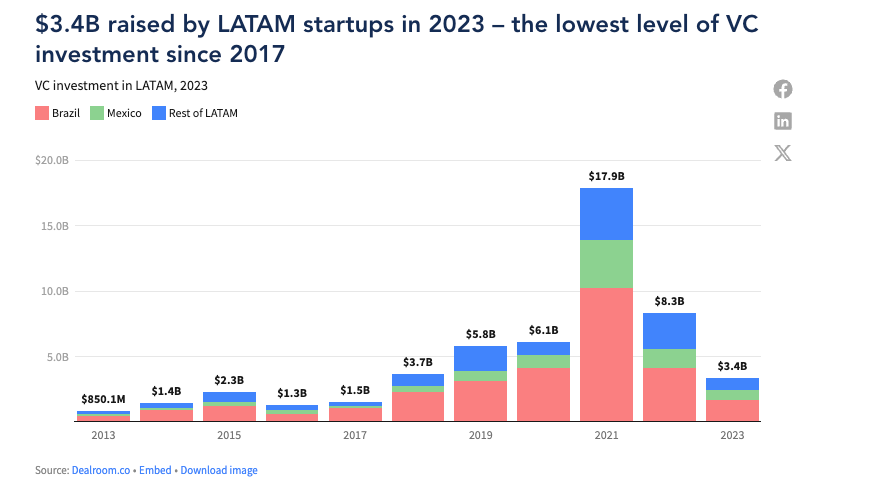

In 2021, LATAM’s startups enjoyed a VC funding boom. $17.9B was pumped into the ecosystem, a 193% increase from the previous year. The continent’s tech potential played a role in this of course, but so did low interest rates. As the latter have risen, VC funding has decreased, both in LATAM and elsewhere.

Some commentators view 2021 as an anomaly, hinting that LATAM’s ecosystem maybe wasn’t worthy of that money. I take a different stance.

2021’s funding tsunami did create issues such as hazy business models, irrational valuations and financial exuberance. But these are growing pains in a rapidly maturing ecosystem. LATAM’s potential remains and better yet, lessons learnt from the 2021 episode exacerbate that potential. The ecosystem is wiser and sharper.

This is exciting. VC funding fluctuates more as a matter of macro-economic policies than of swings in interest towards VC as an asset class. So logically, LATAM’s VC funding will rise again. Excitement is picking up, as witnessed during Colombia Tech Week. Only this time, the continent’s founders are prepared.

Source: Dealroom

Next-gen founders

We owe a lot to previous generations of LATAM founders. They are the ones that built up to the 2021 euphoria. Pre-2021, LATAM founders lived in a scarcity mindset: local investors weren’t interested in VC, so founders scrambled for any foreign VC deal they could get. If Sequoia wanted to invest, you took the deal, even if the terms were iffy.

Many founders (myself included) worked at these startups. By observing, we became more astute on fundraising. The previous generation of founders also did the grunt work of opening up investor networks, both local and foreign. The “next-gen” founders that popped out of these startups (ie: “mafias”) have four main advantages.