How a Ukrainian VC thinks in 2023

Forcibly strengthened by the war, Ukrainian founders are ready to regain the momentum garnered before the invasion.

Biography

Andrew Zinchuk is a VC & an entrepreneur with extensive experience in all stages of a startup ecosystem. He is the managing partner at ZAS Ventures, a Ukraine-focused VC fund. He’s advised 100+ startups by acting as an advisor & mentor at Antler, Seedstars, EO Business Incubators & Ukrainian Startup Fund.

What was the state of Ukraine’s startup ecosystem before Russia’s invasion?

I personally moved back from New York to Ukraine in 2014, following the Revolution of Dignity. From that point until the beginning of the full-scale invasion in February 2022, the ecosystem was growing rapidly, bolstered by a couple of important successes.

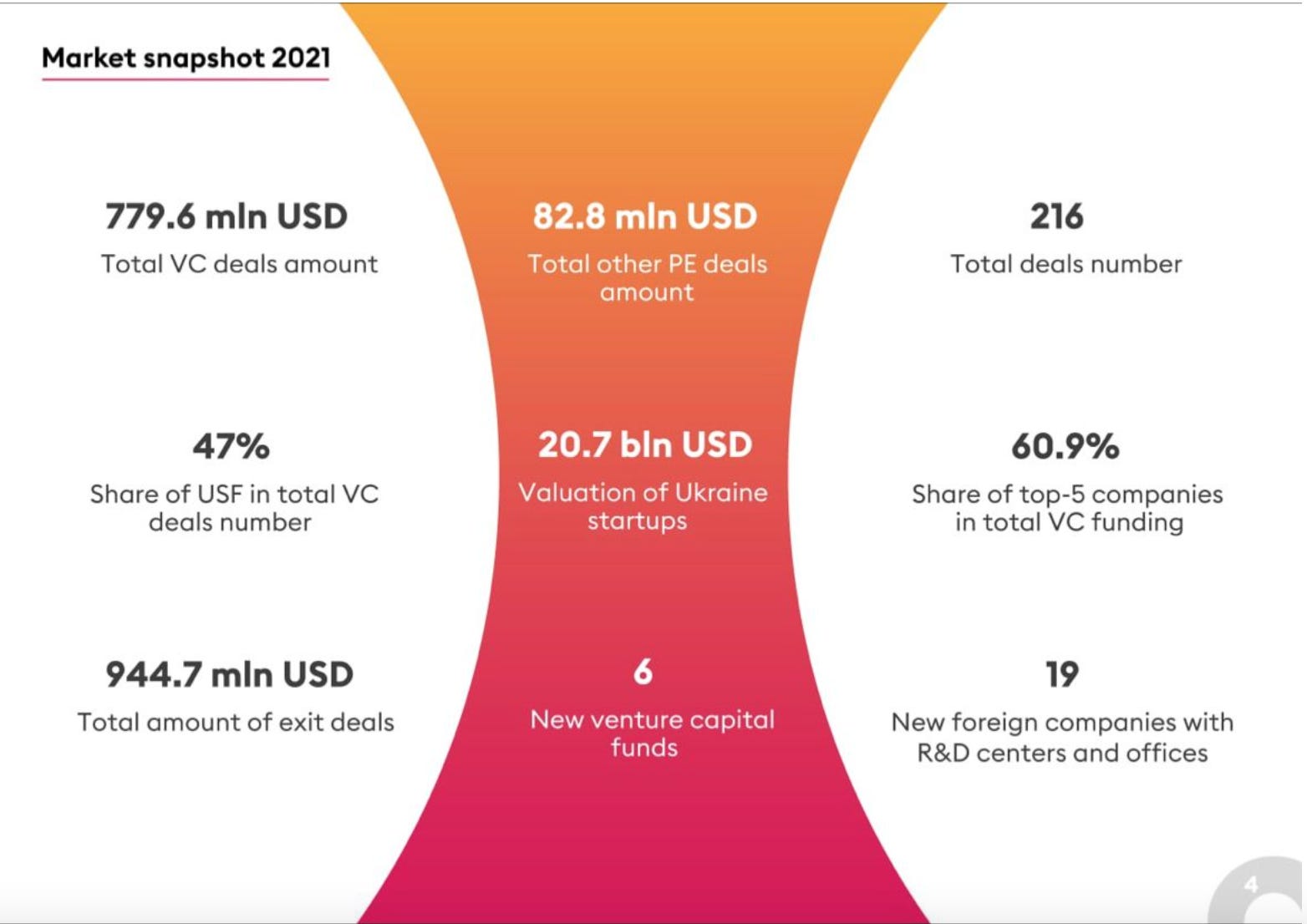

Renowned tech companies such as Gitlab, PeopleAI and Grammarly all have their roots in Ukraine. Their growth buoyed Ukrainian VC funding numbers, which reached a record $800M in 2021. Only 8% of that money went to early-stage startups, however.

I also joined the Ukrainian Venture Capital Association in 2017. Up until the war, the ecosystem as a whole was developing, with new incubators and accelerators popping up throughout the country. Interest in venture capital was growing. Startup Blink ranked Kyiv as one of the best 10 startup cities in Europe.

Ukraine has always had strong human capital, especially in tech where it’s been an IT outsourcing hub for years. What changed in the past decade was that our local talent started building their own companies, instead of doing it for someone else.

What did the war change?

First, our entire domestic market disappeared. Early-stage Ukrainian startups focusing on Ukrainian consumers died instantly, as the economy turned to a survival, wartime one. B2B startups selling to companies outside of Ukraine had a better chance of making the cut.

Second, a considerable number of startup founders and employees joined the war effort, either by draft or by volunteering. Entire teams were dismantled, making the operations of many startups impossible. The problem is outsized as men make up a heavy majority of the ecosystem, and they are the ones joining the army. Some women startup team members moved abroad to try and keep their startups afloat.

Third, constant air attacks by Russia have severely damaged key Ukrainian infrastructure, including power grids. This leads to power cuts, which hurts productivity. The Ukrainian IT sector as a whole, not just startups, has suffered from this.

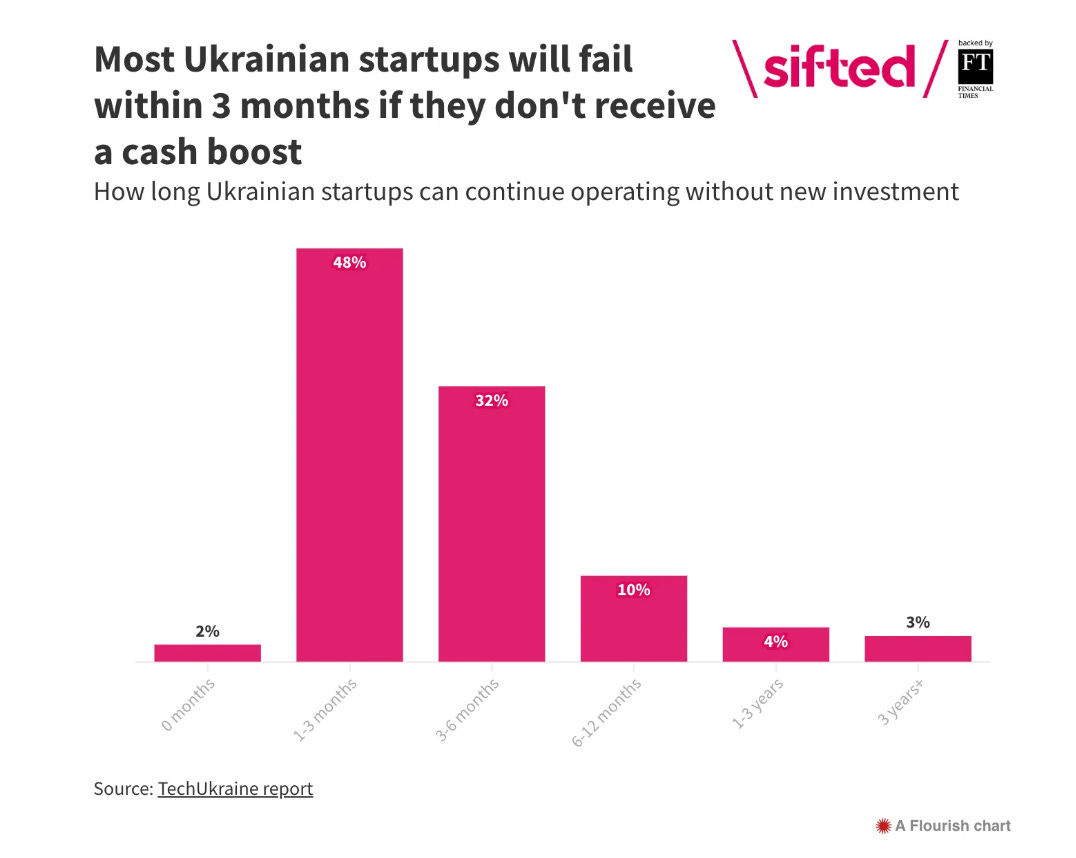

Last, and most problematic, local startup funding completely dried up. Due to the youth of the ecosystem, most local startup funding comes from either corporates or family offices, and the war turned off both of those sources.

Corporates, who mostly invested in startups as a “side hustle”, shifted their priorities.

Family offices, whose main activity often revolves around industrial activity, suddenly had a more important use for their spare money than investing in exciting upshots.

How has the Ukrainian government prioritized the startup sector during the war?

The Ukrainian Startup Fund, the government’s main startup initiative, redirected all of its money toward the army. The USF team tried their best to keep their involvement in the ecosystem alive, without money at their disposal.

The current situation forces the government to place its efforts where it’s most useful: the defense of Ukraine’s territory. In that vein, they recently launched the Brave 1 Fund to foment innovation in drones and other military technology.

With regard to future reconstruction, the agenda looks different. The government wants to double the number of jobs in IT, and make the tech sector Ukrainian GDP’s main contributor.

That goal is also a societal one: once the war is over, scores of men will come back home, looking for jobs. A booming IT sector can provide some of those.

Why is it a good time to invest in Ukrainian startups?

I would say it’s always a good time to invest in Ukrainian startups. The Ukrainian tech talent pool is fantastic, and the cost of building here is drastically lower. A $400K runway grants you many more months than it would in the US.

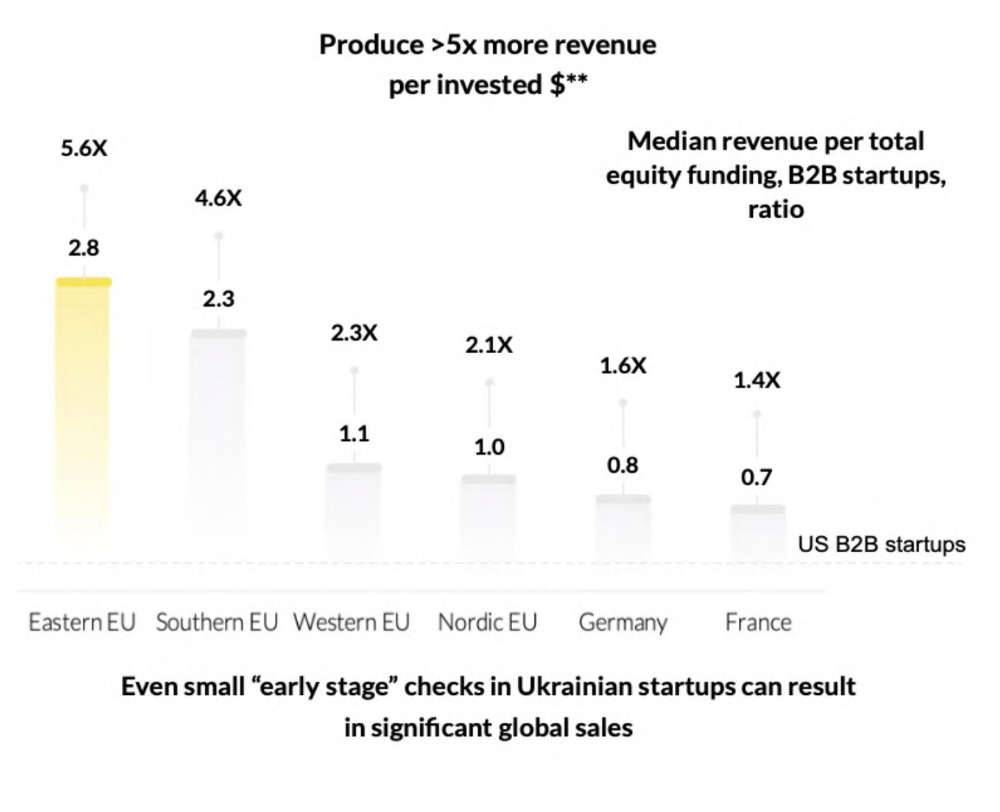

The “bang for the buck” of investing in Ukrainian startups is higher than in the US. Ukrainian valuations are low, on average 6x lower than US ones.

Add to that the fact that this particular generation of founders has gone through what many can only imagine. They are battle-hardened, extremely resilient, and apt to face hard challenges.

Any last words?

I'm very optimistic about the future of the Ukrainian startup ecosystem. It has been growing steadily over the past decade ranking as high as 34th in the world before the war. Russia’s unprovoked aggression caused a setback, but the ecosystem is still top 50 worldwide.

Several factors could influence its development over the next ten years:

Government Support: Ukrainian government resumed investing in policies and initiatives that foster entrepreneurship and support startups. This will create a more favorable environment for innovation and growth.

Investment and Funding: Access to funding is crucial for startups to scale and expand. After the war, there will be a considerable boom/increase in local and foreign investments. Ukrainian startups will have more significant opportunities to develop and compete globally.

Tech Talent and Education: Ukraine has a strong pool of skilled tech talent, and with a focus on improving education in relevant fields, the country could become an even more attractive destination for startups looking for talented professionals.

International Collaboration: Building strong ties with international markets and collaborating with global players could help Ukrainian startups access larger customer bases and more resources.

Industry Focus: Focusing on specific industries or niches within the startup ecosystem can also influence its growth. Ukraine has already made strides in IT and software development. The war also boosted and turned Ukraine into a powerhouse for drone, dual-purpose, military, and defense tech startups, but there could be emerging opportunities in other verticals.

Overall, suppose the positive trends continue, and the necessary support and conditions are provided. In that case, Ukraine’s startup ecosystem will be thriving in 10 years and can get into the top 20 ecosystems in the world.

We will see a significant increase in the number of Ukrainian-founded unicorns, more funding opportunities, greater international recognition, and an ecosystem fostering innovation and entrepreneurship.

The Realistic Optimist’s work is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice.