Biography

Pedro Vallenilla is the CEO and co-founder of Cashea. Cashea is Venezuela’s first buy-now-pay-later (BNPL) app.

Launched in 2022, Cashea’s growth has been explosive. According to the company, 28% of Venezuela’s adults have downloaded the app and 1% of Venezuela’s GDP flows through Cashea. It is shooting to triple that mark by the end of the year.

Cashea users can pay for items through interest-free installments at over 4,000 merchants. Cashea takes a commission on merchants offering Cashea as a payment method (since it generally increases propensity to buy).

What is the state of Venezuela’s credit card industry, which should theoretically be your competitor?

Venezuela is a special case. It isn’t a developing country where consumer credit is a novelty. 14 years ago, when I launched my first startup, local merchants told me that 90% of transactions flowed through credit cards. When I launched Cashea two years ago, merchants told me that number had dropped below 1%.

What happened?

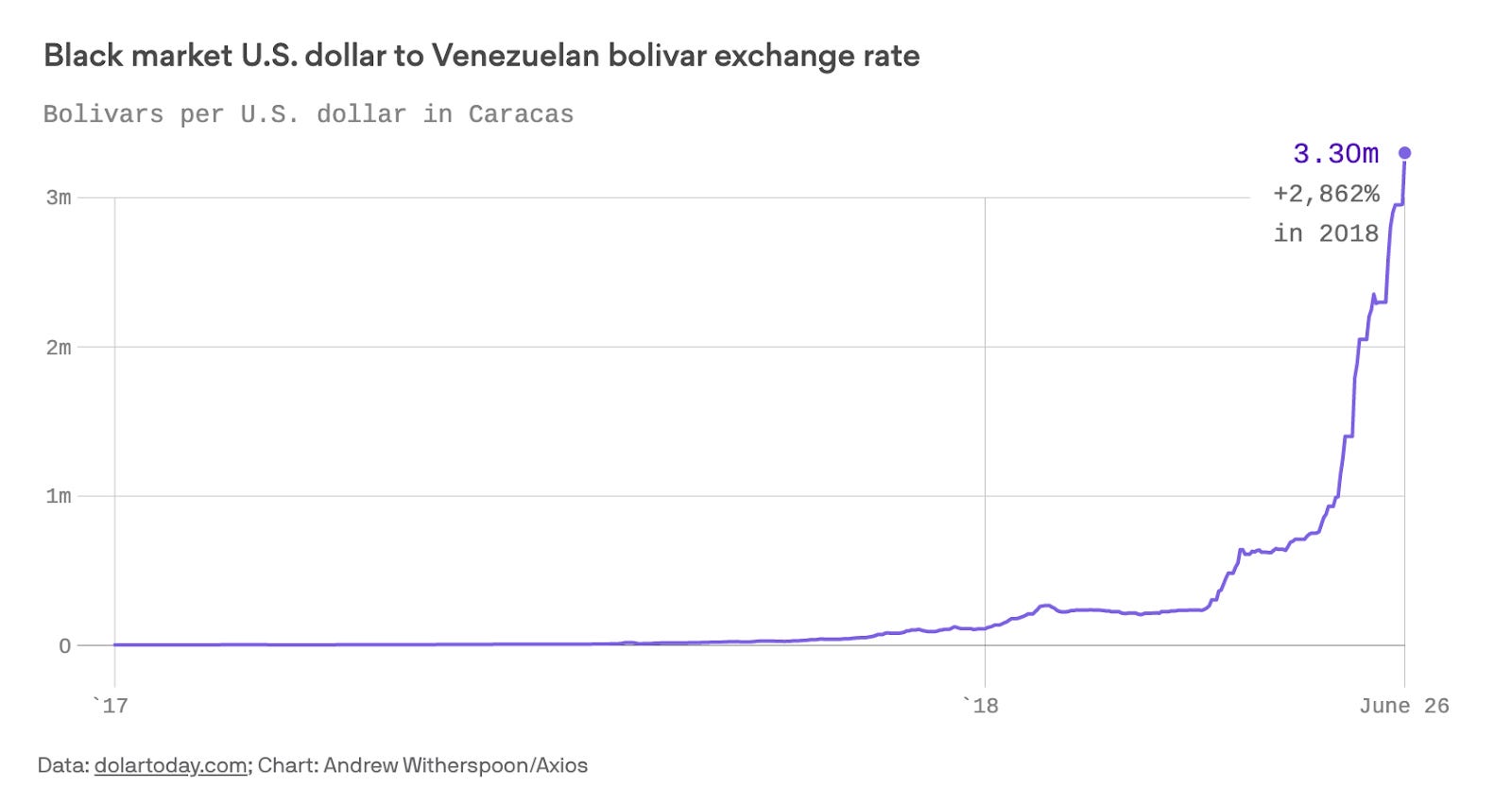

For the past decade or so, Venezuela has endured devastating economic turmoil, suffering from brutal hyperinflation and seeing its GDP reduced by 75%. The crisis was a perfect storm of policy-driven distortions, a plunge in oil prices and production, topped by sweeping economic sanctions.

Credit cards stopped making sense for banks because of negative real interest rates: interest rates were legally capped at around 28% while inflation was in the triple digits.

Imagine a Venezuelan bank issuing credit cards. The bank lends 2000 bolívares which, for the sake of argument, is worth $100. Over a couple of months, the bolívar’s value plunges. Its customer still owes 2000 bolívares, but that is now worth $30. Regulation places a cap on interest rates, so the bank can’t increase the repayment amount.

The customer pays back 2000 bolívares as planned, but it’s worth $30, not the $100 it originally lent out. The bank lost $70. Why would it continue issuing credit cards?

Recently, thanks to some reforms, the economic crash has cooled. We are even seeing small growth rates. But since the economic crisis, it has become illogical for Venezuelan banks to issue credit cards. This has created credit-starved Venezuelan consumers.

Hence Cashea’s pertinence.

Graph source: Axios (up to date figures here)

Speaking of regulation: how have you approached it?

I launched my first startup (TuDescuentón) in 2009. It was an e-commerce site aggregating daily deals and coupons. We ran into regulatory problems, which hindered our growth. I promised myself that if I launched another startup in Venezuela, I would get the regulatory aspect right.

Silicon Valley lore encourages founders to “ask for forgiveness, not permission”. In our markets, it is nonsensical. If the regulator can close your business overnight, you better ask for permission.

So we did, accepting the additional time that would incur. Our proposal was 1,500 pages long. It was rejected by the regulator four times. Our 5th iteration was the lucky one and we got the green light to launch. The whole process took around 8 months.

It was worth it a thousand times over. I’ve seen other local startups launch quickly but run into a lethal regulatory wall once they gain traction. We’d rather be alive than quick.

How have local banks reacted to your presence?